By Erik Randolph, GCO Contributing Scholar

Last December, President Trump signed into law changes to the federal income tax. One of the supposed achievements was the elimination of the marriage penalty. This is not entirely correct.

I recently analyzed marriage penalties for the Georgia Center for Opportunity (GCO). Summarized in a policy briefing, my analysis found that Congress only succeeded in eliminating the marriage penalty if a couple does not have children. If they do have children, the marriage penalty is alive and well.

Certainly, it is a positive change that two individuals without children can now marry without having a tax shock when they file their federal income taxes. This is a fairer system ensuring they do not have a higher tax bill just because they got married. Congress can be proud of this achievement.

However, it’s unfortunate that the tax code continues to punish couples with children.

To make matters worse, the poor face an additional marriage penalty if they receive food stamps, and it doesn’t matter if they have kids or not.

The recent analysis I conducted on the food stamp marriage penalty relied on computations of 256 wage combinations of what two individuals might earn. These combinations ranged from earning nothing up to earning the national median wage. For every wage combination considered, the food stamp program discourages marriage.

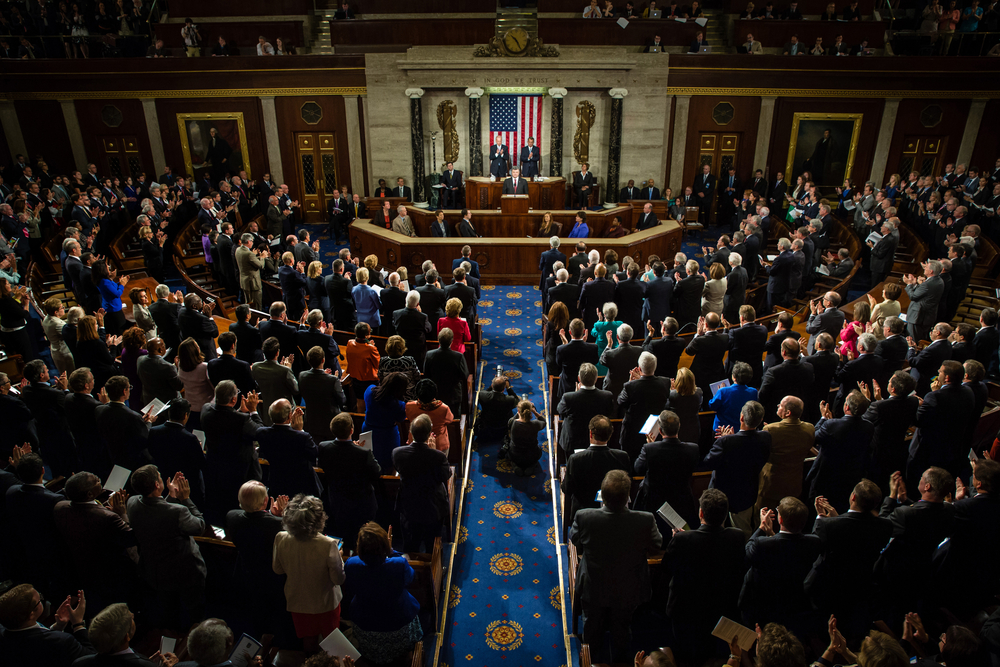

The good news is that Congress has an opportunity right now to fix the marriage penalty in the food stamp program. The U.S. Senate and House of Representatives have two versions of the Farm Bill to consider. The final version that will come out of the conference committee could eliminate the marriage penalty in the food stamp program.

There are two approaches Congress can take. The first is to get into the details and redesign the food stamp factors that cause the marriage penalty. This approach is lengthier, and given the urgency of passing the Farm Bill, it may be less appealing.

The simpler approach would be to give the states the authority, under the direction of the U.S. Department of Agriculture, to make adjustments to the food stamp program to eliminate the marriage penalty. Although the food stamp program is a federal program, the states administer the program and pay for half of the administrative costs.

Prior research I did for GCO demonstrates that the more welfare programs an individual or family receives, the greater the likelihood for marriage penalties and the greater the severity of those penalties. Therefore, it makes sense to allow states that administer most welfare programs to address the marriage penalties in a coordinated manner.

Once they’ve fixed the marriage penalty in the food stamp program, Congress should revisit the tax code to fix the lingering marriage penalty there. It is unfair for single individuals with children who want to marry to face tax penalties if they do so. Equally unfair is that married couples with children end up paying more in federal income taxes than they would if they were unmarried and living together.

Combined, the penalties provide a strong and perverse disincentive to couples with children to remain unmarried. It is public policy directly opposed to the behaviors we know are most likely to lift people out of poverty and it needs to end. Congress has a chance to start addressing the problem in the Farm Bill, and it’s an opportunity they shouldn’t miss.

For more on GCO’s recent research on the marriage penalty, check out “How the Food Stamp Program and the U.S. Tax Code Continue to Penalize Marriage.”

Trackbacks/Pingbacks