by Georgia Center for Opportunity | Oct 25, 2017

Georgia Center for Opportunity focuses policy reform efforts around the success sequence. Research shows that those who graduate from high school, get a job, get married, and have kids (in that order) are less likely to end up in poverty. In fact, only 2 percent who complete these steps will be in poverty at any given time.

A comparison between Georgia’s three largest counties—Cobb, Fulton, and Gwinnett—shows there is still work to be done in improving education, employment, and healthy families.

Between Cobb, Fulton, and Gwinnett there are 40,000 children living in families where no parent has a full-time job. This means that more families in our community are struggling to provide for those they love, and many are forced to use welfare benefits. Between the three counties, nearly 90,000 households were on food stamps in 2013.

For education, 6 to 10 percent of 16-19 year olds in these counties are not in school and not working. This represents more than 10,000 Georgians who are not able to live up to their full potential. One alarming statistic compares the number of students who graduate from high school on time and the crime ratio for adolescents 17 years and older. While the majority of Georgia students graduate on time, more than 23,000 do not. In comparison, more than 28,000 adolescents were arrested in 2016.

On the family side, many children across the three counties live in a single-parent family: 28.8 percent for Cobb, 39 percent for Fulton, and 27.6 percent for Gwinnett. This means more than 188,000 children live in a single-parent home. While single-parents do their best for their family, the fact remains that it is easier for two parents to share the burden of running a family.

These statistics show how much work is left to be done. GCO is committed to delivering solutions so all Georgians can live a flourishing life.

by Georgia Center for Opportunity | Oct 23, 2017

Studies show that couples who spend quality time together stay together.

That’s why 75 couples in the Norcross and Peachtree Corners area have decided to take an evening to invest in their relationship by attending the Healthy Family Initiative’s date night event, “Twogether Forever: You and I.” The evening, which has sold out completely, will be a time of romance for couples to reconnect while they enjoy dinner, dancing, entertainment, games, and more.

While it is often difficult for couples to break away from responsibilities, the evening aims to be free of distractions, offering a time strictly devoted to marriage relationships.

Taking time for a date night improves the quality and stability of marriages. Husbands and wives who engaged in spending time with their spouse at least once a week are approximately 3.5 times more likely to report being “very happy” in their marriages, compared to those who enjoyed less quality time with their spouse.

Healthy marriages are the cornerstone of strong families, which means investing time into your romantic relationship is worth every minute. Our goal at HFI is to provide the tools and time for couples and families to connect in a meaningful way, making their relationships and family dynamics indestructible against all of the stresses life may bring.

For more information about this date night/join the waiting list, or learn more about future events, visit HFIGeorgia.org.

by Georgia Center for Opportunity | Oct 11, 2017

Many years ago we began laying the groundwork for the Healthy Families Initiative (HFI), and two years ago we kicked off a public campaign to change the hearts and minds of those in the Norcross and Peachtree Corners areas. Your support, partnerships, and prayers have allowed us the opportunities to continue to expand the HFI program in ways we originally only dreamed about. So, it’s with great excitement we share with you exciting news about the growth of HFI.

Online classes are here! Participants can get all the same valuable information and tools from the FREE community classes, but in the comfort of their home and at their own pace.

It is our hope that having a FREE online option will allow more people to build healthy, happy, and lasting relationships with their spouses, families, and children.

As of today, the following courses are available for enrollment through the HFI website:

- ePrep: Maximizing Your Romantic Relationship

- For Dating, Engaged, or Married Couples

- This course is for couples who want to make their relationship the best it can be. It will challenge you to think about things you’ve never thought about before and help you to see yourself, your partner, and your relationship in a whole new light.

*This course uses material from Prevention and Relationship Enhancement Program (PREP).

- Head Meets Heart (formerly known as Sex, Lies, and Relationships)

- Primarily for singles

- This program teaches students how to pace the development of a new relationship in a healthy way, and it also covers the five areas in a partner’s life that accurately predict what type of person they’ll be in a long-term relationship.

* This course uses material from Dr. John Van Epp’s How to Avoid Falling in Love with a Jerk or Jerkette.

We know schedules are busy, and the online courses offer a self-paced journey to more effective communication in your life. Plus, they’re all free!

It is our goal to continue to grow the online courses offered – stay tuned for more!

by Georgia Center for Opportunity | Sep 29, 2017

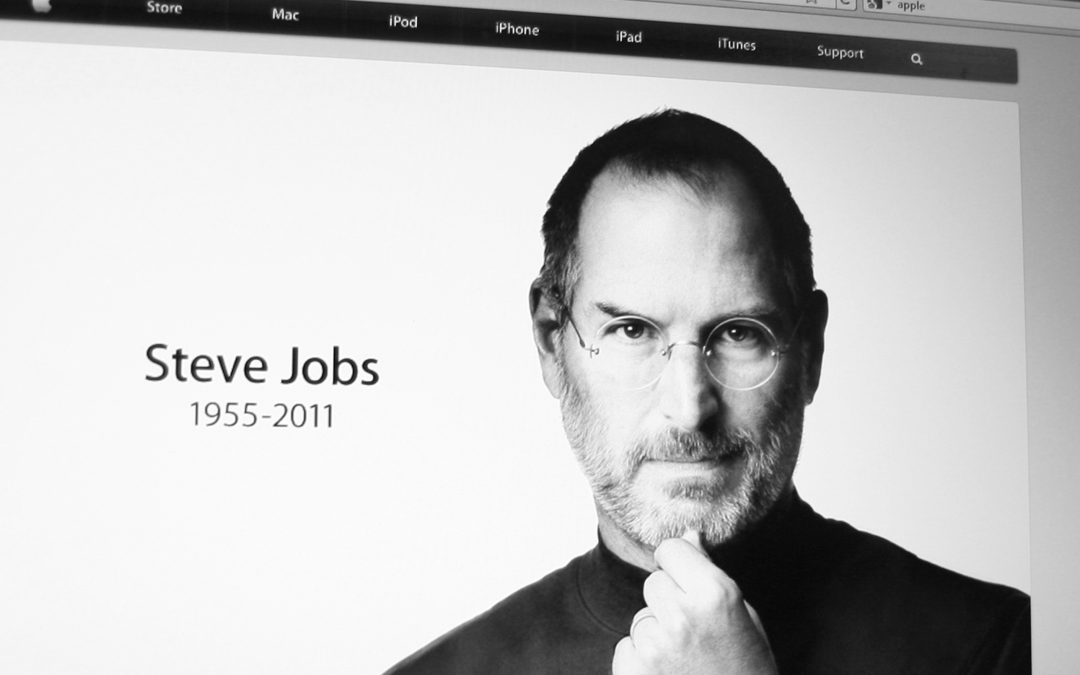

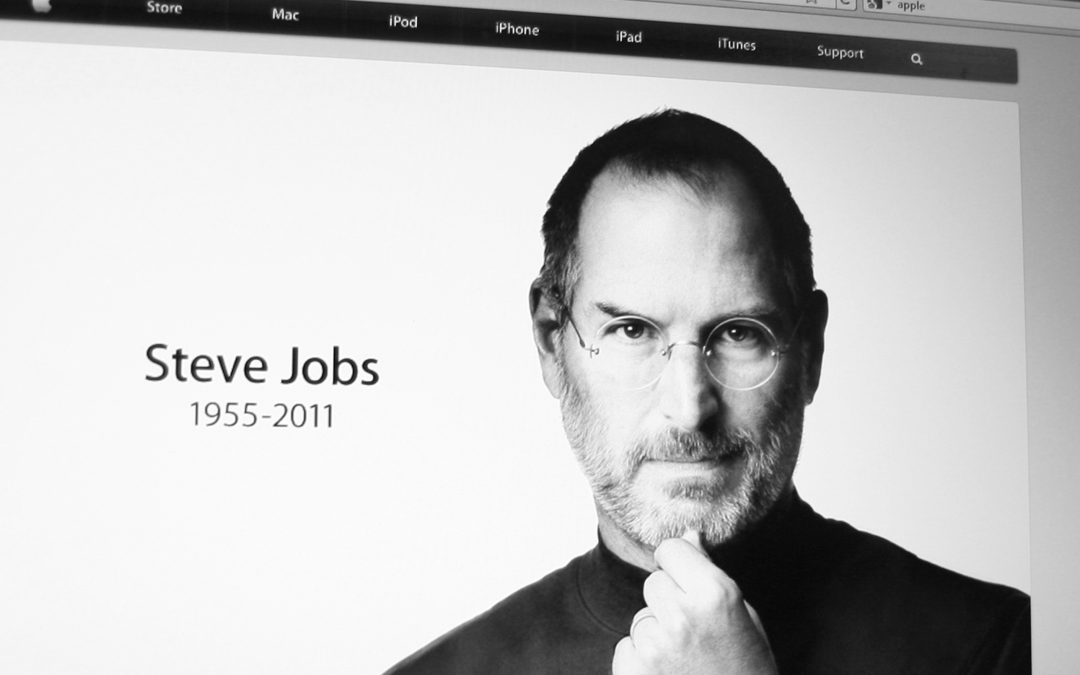

Earlier this month, Apple made waves by introducing the iPhone 10. Since being unveiled, the updated smartphone and several other new products have received praise as the latest credit to Steve Jobs’ tech legacy.

Years following his death, Americans still remember the Apple founder’s dedication to forward progress. While he is regarded as a visionary leader in the tech industry, many are unaware that his contribution to education innovation has also created lasting interest.

Jobs, adopted into a blue-collar family, long touted the importance of robust school choice.

“Equal opportunity to me, more than anything, means a great education,” Jobs once said in a 1995 interview with the Smithsonian Institution.

“I believe very strongly that if the country gave each parent a voucher for $4,400 that they could spend at any accredited school, several things would happen,” he later said. “Number one, schools would start marketing themselves like crazy to get students. Secondly, I think you’d see a lot of new schools starting…. I believe that they would do far better than any of our public schools would. The third thing you’d see is… the quality of schools again, just in a competitive marketplace, start to rise.”

His dream for unlocking potential in the education system didn’t stop there.

Prior to his death, Jobs began exploring options to digitize classrooms and make expensive learning materials, like updated textbooks, more affordable and accessible through technology. Imagining learning environments with greater flexibility and creativity, he also advocated for less bureaucracy and more teacher autonomy over curriculum.

Like with the newest version of his iPhone, Jobs may not have lived long enough to see his dream of educational choice for all become a reality, but his ideas continue to inspire leadership and progress toward a day when each child has meaningful education options.

by Georgia Center for Opportunity | Sep 11, 2017

Amid growing acknowledgment for efforts to reduce prison recidivism rates in Georgia, the Georgia Center for Opportunity (GCO) has been named as a finalist for the highly competitive Atlas Network Templeton Freedom Award.

The honor recognizes GCO for recent efforts to assist formerly incarcerated individuals with successful reintegration into society. Through work with several community partners, the organization has orchestrated an effort that focuses on the rehabilitation and restoration of former offenders with their family and community. Aiming to help newly-released individuals gain employment and reconnect with their loved ones, GCO’s program has been credited with positively impacting the state’s justice system.

“We’re humbled to be considered as a global leader in promoting freedom and human flourishing, and congratulate the other finalists for their tremendous successes,” said Randy Hicks, President and CEO of GCO.

“Several hard-won policy changes and the work of many partners have contributed to a reduction of inmates in the state’s prison system,” Hicks added. “We predict the reforms spearheaded by GCO will continue to allow more individuals to successfully reenter society and become less likely to recidivate.”

The Atlas Network’s CEO, Brad Lips, praised GCO’s innovative approach to criminal justice reform.

“GCO’s Prisoner Reentry Initiative demonstrates that compassion for the incarcerated and their families can be aligned with the interests of taxpayers and public safety,” Lips said. “It’s a wonderful initiative that deserves to be emulated.”

GCO is included among seven globally-selected finalists who have made strides in public policy that encourage prosperity, innovation, and human fulfillment via free competition. Other finalists include the Beacon Center of Tennessee, based in Nashville, Tenn., the IMANI Center for Policy and Education, based in Accra, Ghana, Instituto de Estudos Empresariais (IEE), based in Porto Alegre, Brazil, Instituto Mexicano para la Competitividad (IMCO), based in Mexico City, Mexico, and the Macdonald-Laurier Institute for Public Policy (MLI), based in Ottawa, Canada.

All finalists will receive $25,000, while the winning organization will receive $100,000.

The winner of the Atlas Network’s Templeton Freedom Award will be announced during the Liberty Forum and Freedom Dinner in New York City on November 8.

To learn more about policy solutions championed in GCO’s prisoner re-entry work visit GeorgiaOpportunity.org/Employment/Prisoner-reentry.

by Georgia Center for Opportunity | Aug 28, 2017

In the coming decades, could so-called “middle skills” jobs be a key factor in reversing the contemporary epidemic of non-working males in the U.S.? There is reason to hope the answer is a resounding yes.

A phenomenon thoroughly documented by the American Enterprise Institute’s Nicholas Eberstadt and other scholars, an estimated seven million men in their prime working years of 25 to 54 years-old are absent from the U.S. labor force. Several factors tend to characterize these men: they are more likely to be minorities (particularly African-American), undereducated (no more than a high school diploma, and often less), and with a history in the criminal justice system. One attribute characterizes all of them—they are entirely disconnected from work. They’ve dropped out, unplugged, and given up on joining the labor force altogether.

Reasons for this are multifaceted, running the gamut from the challenges of obtaining work with a criminal record to addictions (alcohol and opioids particularly) to reliance on disability payments, family members, or government support to survive.

Closer to home in Georgia, this impactful map created by The New York Times shows where the non-working male problem is particularly bad, including areas where northward of 42% of these males are non-working, spanning Georgia’s larger metro areas to small rural regions.

Could middle-skills jobs be key to reducing this trend? It’s estimated that 29 million middle-skills jobs exist in the US today—40 percent of them with annual salaries in excess of $50,000 (for more, download this PDF). These jobs require less than a bachelor’s degree but more than a high-school diploma, making shorter-term training programs and credentials—such as associate degrees, certificates, and apprenticeships—an ideal option. Click here for more on the demand for middle skills jobs in Georgia.

There are a number of reasons to hope that we can achieve some success by placing more emphasis on these types of alternatives:

- Offering guided training pathways that lead to a workforce-ready credential will give non-working men a greater motivation to engage, compared to the six (or more) years needed to finish a typical bachelor’s degree.

- Offering “stackable credentials” that allow students to gradually and sequentially build their skillset over a period of time will allow these men to quickly see progress and ROI in their training journey.

- Building condensed and accelerated training schedules would empower men to finish what they start and improve graduation rates at community colleges and other training programs.

The Georgia Center for Opportunity is committed to making these kinds of opportunities available for all Georgians through our College and Career Pathways Initiative.